The Rise in Bitcoin Price

Introduction

Bitcoin has become one of the most talked-about financial assets in the modern digital era. Since its creation in 2009, Bitcoin has experienced dramatic price movements that have captured global attention. Among these movements, the rise in Bitcoin price is often the most celebrated and discussed phenomenon.

The rise in Bitcoin price refers to periods when Bitcoin experiences a significant and sustained increase in value. These upward trends are driven by a combination of technological innovation, market demand, investor confidence, and global economic conditions. This article is written in a natural, handwritten-style tone and provides a comprehensive explanation in English about the rise in Bitcoin price, its causes, impacts, and what it means for investors.

Understanding Bitcoin Price Growth

Bitcoin operates in a decentralized market without central control. Its price is determined entirely by supply and demand across global exchanges that operate around the clock.

One of the most important characteristics of Bitcoin is its limited supply. Only 21 million Bitcoins will ever exist. This scarcity plays a major role in driving price increases, especially when demand grows rapidly.

What Does a Rise in Bitcoin Price Mean

A rise in Bitcoin price occurs when its value increases steadily over time or surges sharply within a short period. Price increases can be gradual or explosive, depending on market conditions.

For long-term investors, rising prices often confirm confidence in Bitcoin as a store of value or long-term investment. For traders, price increases create opportunities for profit but also involve higher risk.

Main Factors Behind the Rise in Bitcoin Price

Several key factors contribute to the rise in Bitcoin price.

Increased Adoption

One of the strongest drivers of Bitcoin’s price increase is growing adoption. More individuals, businesses, and institutions are using Bitcoin for investment, payments, and value storage.

As adoption expands, demand increases while supply remains limited, pushing prices higher.

Institutional Investment

Institutional involvement has significantly influenced Bitcoin’s price growth. When large financial institutions, hedge funds, and corporations invest in Bitcoin, it increases market credibility and demand.

Institutional buying often signals confidence and attracts more investors, accelerating price rises.

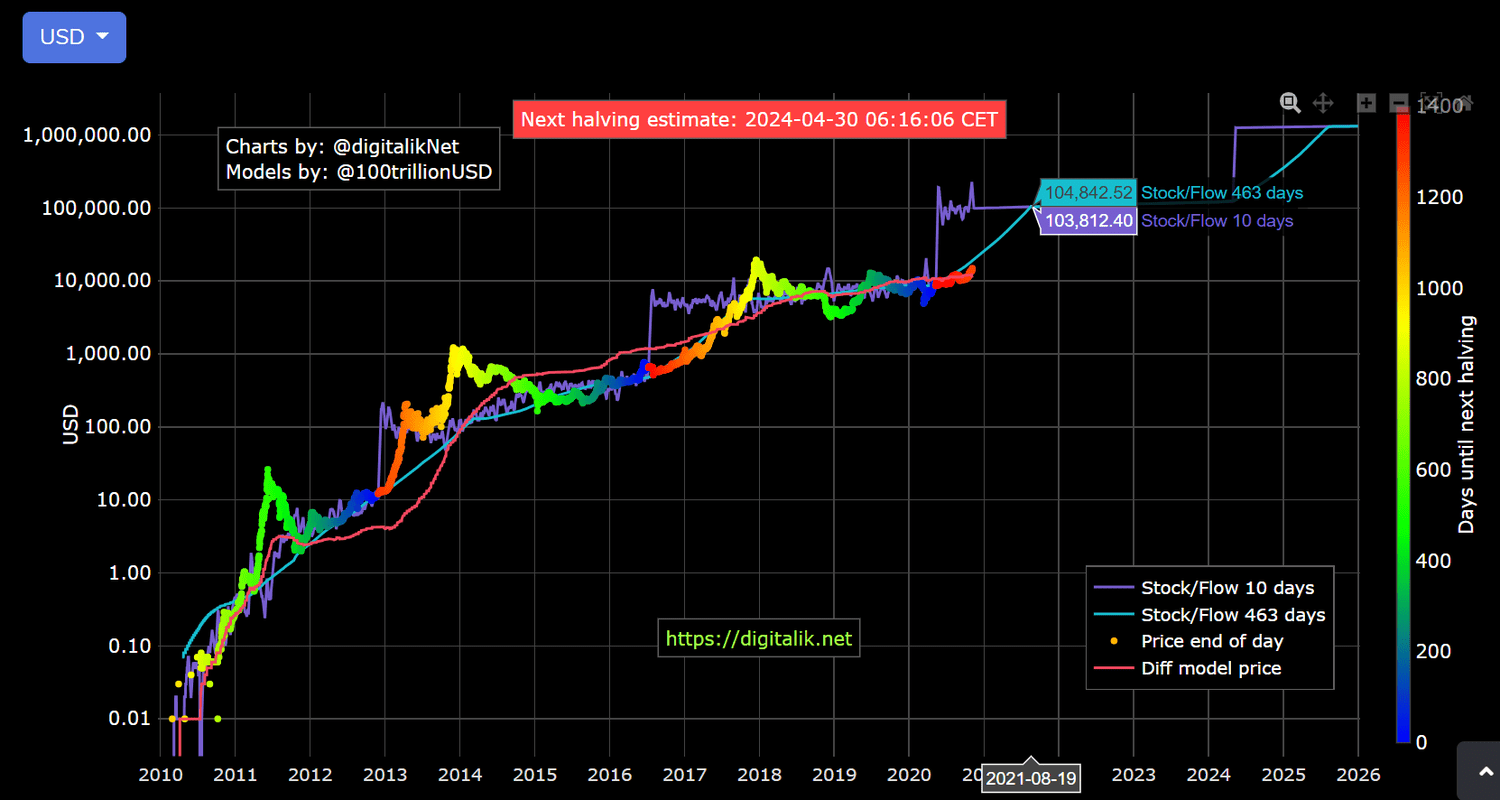

Scarcity and Halving Events

Bitcoin halving events reduce the reward miners receive for validating transactions. This reduction in new Bitcoin supply historically contributes to price increases.

When supply growth slows and demand remains strong, prices tend to rise.

Macroeconomic Conditions

Global economic conditions also play an important role. Inflation concerns, currency devaluation, and low interest rates often drive investors toward alternative assets like Bitcoin.

Bitcoin is increasingly viewed as digital gold, making it attractive during times of economic uncertainty.

Positive Market Sentiment

Market sentiment strongly affects Bitcoin prices. Positive news, technological developments, and successful adoption stories can generate optimism.

Optimistic sentiment encourages buying, which pushes prices higher.

Impact of Rising Bitcoin Prices on the Market

The rise in Bitcoin price affects the entire cryptocurrency ecosystem.

Altcoins

When Bitcoin prices rise, many alternative cryptocurrencies also experience price increases. This phenomenon is often referred to as a bull market.

Investor Confidence

Rising prices boost investor confidence and attract new participants to the market. Increased confidence often leads to higher trading volumes.

Mining Industry

Higher Bitcoin prices improve mining profitability, encouraging investment in mining infrastructure and technology.

Psychological Effects of Bitcoin Price Increases

Price increases generate excitement, optimism, and sometimes excessive enthusiasm. Fear of missing out often drives investors to buy during rising markets.

While optimism can support growth, emotional decision-making may increase risk if prices become overheated.

Historical Bitcoin Price Rallies

Bitcoin has experienced several major price rallies throughout its history. Each rally was driven by unique factors such as technological milestones, increased adoption, or macroeconomic shifts.

Studying these historical rallies helps investors understand patterns and manage expectations.

Is the Rise in Bitcoin Price Sustainable

Not all price increases are sustainable. Some rallies are followed by corrections or market downturns.

Sustainability depends on strong fundamentals, continued adoption, and supportive economic conditions.

Opportunities and Risks During Rising Markets

Rising Bitcoin prices create opportunities for profit but also increase risk.

Opportunities

Investors may benefit from capital appreciation and increased market momentum.

Risks

Rapid price increases can lead to bubbles and sharp corrections.

Lessons for Investors from Rising Bitcoin Prices

Bitcoin price increases offer important lessons.

First, discipline is essential. Emotional buying during rallies can lead to poor decisions.

Second, diversification helps manage risk.

Third, understanding market cycles helps investors prepare for corrections.

The Role of Media and Social Networks

Media coverage and social networks play a significant role in amplifying Bitcoin price increases. Positive headlines and viral content can accelerate buying pressure.

Investors should balance media influence with careful analysis.

Future Outlook for Bitcoin Price Growth

Bitcoin’s future price growth depends on adoption, regulation, technological development, and global economic trends.

While uncertainty remains, many believe Bitcoin will continue to play an important role in the global financial system.

Conclusion

The rise in Bitcoin price reflects growing interest, adoption, and confidence in cryptocurrency. While price increases offer exciting opportunities, they also require careful analysis and risk management.

By understanding the factors behind Bitcoin’s price growth, investors can make wiser decisions and approach the market with confidence and long-term perspective.

The Rise in Bitcoin Price

Introduction

Bitcoin has become one of the most talked-about financial assets in the modern digital era. Since its creation in 2009, Bitcoin has experienced dramatic price movements that have captured global attention. Among these movements, the rise in Bitcoin price is often the most celebrated and discussed phenomenon.

The rise in Bitcoin price refers to periods when Bitcoin experiences a significant and sustained increase in value. These upward trends are driven by a combination of technological innovation, market demand, investor confidence, and global economic conditions. This article is written in a natural, handwritten-style tone and provides a comprehensive explanation in English about the rise in Bitcoin price, its causes, impacts, and what it means for investors.

Understanding Bitcoin Price Growth

Bitcoin operates in a decentralized market without central control. Its price is determined entirely by supply and demand across global exchanges that operate around the clock.

One of the most important characteristics of Bitcoin is its limited supply. Only 21 million Bitcoins will ever exist. This scarcity plays a major role in driving price increases, especially when demand grows rapidly.

What Does a Rise in Bitcoin Price Mean

A rise in Bitcoin price occurs when its value increases steadily over time or surges sharply within a short period. Price increases can be gradual or explosive, depending on market conditions.

For long-term investors, rising prices often confirm confidence in Bitcoin as a store of value or long-term investment. For traders, price increases create opportunities for profit but also involve higher risk.

Main Factors Behind the Rise in Bitcoin Price

Several key factors contribute to the rise in Bitcoin price.

Increased Adoption

One of the strongest drivers of Bitcoin’s price increase is growing adoption. More individuals, businesses, and institutions are using Bitcoin for investment, payments, and value storage.

As adoption expands, demand increases while supply remains limited, pushing prices higher.

Institutional Investment

Institutional involvement has significantly influenced Bitcoin’s price growth. When large financial institutions, hedge funds, and corporations invest in Bitcoin, it increases market credibility and demand.

Institutional buying often signals confidence and attracts more investors, accelerating price rises.

Scarcity and Halving Events

Bitcoin halving events reduce the reward miners receive for validating transactions. This reduction in new Bitcoin supply historically contributes to price increases.

When supply growth slows and demand remains strong, prices tend to rise.

Macroeconomic Conditions

Global economic conditions also play an important role. Inflation concerns, currency devaluation, and low interest rates often drive investors toward alternative assets like Bitcoin.

Bitcoin is increasingly viewed as digital gold, making it attractive during times of economic uncertainty.

Positive Market Sentiment

Market sentiment strongly affects Bitcoin prices. Positive news, technological developments, and successful adoption stories can generate optimism.

Optimistic sentiment encourages buying, which pushes prices higher.

Impact of Rising Bitcoin Prices on the Market

The rise in Bitcoin price affects the entire cryptocurrency ecosystem.

Altcoins

When Bitcoin prices rise, many alternative cryptocurrencies also experience price increases. This phenomenon is often referred to as a bull market.

Investor Confidence

Rising prices boost investor confidence and attract new participants to the market. Increased confidence often leads to higher trading volumes.

Mining Industry

Higher Bitcoin prices improve mining profitability, encouraging investment in mining infrastructure and technology.

Psychological Effects of Bitcoin Price Increases

Price increases generate excitement, optimism, and sometimes excessive enthusiasm. Fear of missing out often drives investors to buy during rising markets.

While optimism can support growth, emotional decision-making may increase risk if prices become overheated.

Historical Bitcoin Price Rallies

Bitcoin has experienced several major price rallies throughout its history. Each rally was driven by unique factors such as technological milestones, increased adoption, or macroeconomic shifts.

Studying these historical rallies helps investors understand patterns and manage expectations.

Is the Rise in Bitcoin Price Sustainable

Not all price increases are sustainable. Some rallies are followed by corrections or market downturns.

Sustainability depends on strong fundamentals, continued adoption, and supportive economic conditions.

Opportunities and Risks During Rising Markets

Rising Bitcoin prices create opportunities for profit but also increase risk.

Opportunities

Investors may benefit from capital appreciation and increased market momentum.

Risks

Rapid price increases can lead to bubbles and sharp corrections.

Lessons for Investors from Rising Bitcoin Prices

Bitcoin price increases offer important lessons.

First, discipline is essential. Emotional buying during rallies can lead to poor decisions.

Second, diversification helps manage risk.

Third, understanding market cycles helps investors prepare for corrections.

The Role of Media and Social Networks

Media coverage and social networks play a significant role in amplifying Bitcoin price increases. Positive headlines and viral content can accelerate buying pressure.

Investors should balance media influence with careful analysis.

Future Outlook for Bitcoin Price Growth

Bitcoin’s future price growth depends on adoption, regulation, technological development, and global economic trends.

While uncertainty remains, many believe Bitcoin will continue to play an important role in the global financial system.

Conclusion

The rise in Bitcoin price reflects growing interest, adoption, and confidence in cryptocurrency. While price increases offer exciting opportunities, they also require careful analysis and risk management.

By understanding the factors behind Bitcoin’s price growth, investors can make wiser decisions and approach the market with confidence and long-term perspective.

The Rise in Bitcoin Price

Introduction

Bitcoin has become one of the most talked-about financial assets in the modern digital era. Since its creation in 2009, Bitcoin has experienced dramatic price movements that have captured global attention. Among these movements, the rise in Bitcoin price is often the most celebrated and discussed phenomenon.

The rise in Bitcoin price refers to periods when Bitcoin experiences a significant and sustained increase in value. These upward trends are driven by a combination of technological innovation, market demand, investor confidence, and global economic conditions. This article is written in a natural, handwritten-style tone and provides a comprehensive explanation in English about the rise in Bitcoin price, its causes, impacts, and what it means for investors.

Understanding Bitcoin Price Growth

Bitcoin operates in a decentralized market without central control. Its price is determined entirely by supply and demand across global exchanges that operate around the clock.

One of the most important characteristics of Bitcoin is its limited supply. Only 21 million Bitcoins will ever exist. This scarcity plays a major role in driving price increases, especially when demand grows rapidly.

What Does a Rise in Bitcoin Price Mean

A rise in Bitcoin price occurs when its value increases steadily over time or surges sharply within a short period. Price increases can be gradual or explosive, depending on market conditions.

For long-term investors, rising prices often confirm confidence in Bitcoin as a store of value or long-term investment. For traders, price increases create opportunities for profit but also involve higher risk.

Main Factors Behind the Rise in Bitcoin Price

Several key factors contribute to the rise in Bitcoin price.

Increased Adoption

One of the strongest drivers of Bitcoin’s price increase is growing adoption. More individuals, businesses, and institutions are using Bitcoin for investment, payments, and value storage.

As adoption expands, demand increases while supply remains limited, pushing prices higher.

Institutional Investment

Institutional involvement has significantly influenced Bitcoin’s price growth. When large financial institutions, hedge funds, and corporations invest in Bitcoin, it increases market credibility and demand.

Institutional buying often signals confidence and attracts more investors, accelerating price rises.

Scarcity and Halving Events

Bitcoin halving events reduce the reward miners receive for validating transactions. This reduction in new Bitcoin supply historically contributes to price increases.

When supply growth slows and demand remains strong, prices tend to rise.

Macroeconomic Conditions

Global economic conditions also play an important role. Inflation concerns, currency devaluation, and low interest rates often drive investors toward alternative assets like Bitcoin.

Bitcoin is increasingly viewed as digital gold, making it attractive during times of economic uncertainty.

Positive Market Sentiment

Market sentiment strongly affects Bitcoin prices. Positive news, technological developments, and successful adoption stories can generate optimism.

Optimistic sentiment encourages buying, which pushes prices higher.

Impact of Rising Bitcoin Prices on the Market

The rise in Bitcoin price affects the entire cryptocurrency ecosystem.

Altcoins

When Bitcoin prices rise, many alternative cryptocurrencies also experience price increases. This phenomenon is often referred to as a bull market.

Investor Confidence

Rising prices boost investor confidence and attract new participants to the market. Increased confidence often leads to higher trading volumes.

Mining Industry

Higher Bitcoin prices improve mining profitability, encouraging investment in mining infrastructure and technology.

Psychological Effects of Bitcoin Price Increases

Price increases generate excitement, optimism, and sometimes excessive enthusiasm. Fear of missing out often drives investors to buy during rising markets.

While optimism can support growth, emotional decision-making may increase risk if prices become overheated.

Historical Bitcoin Price Rallies

Bitcoin has experienced several major price rallies throughout its history. Each rally was driven by unique factors such as technological milestones, increased adoption, or macroeconomic shifts.

Studying these historical rallies helps investors understand patterns and manage expectations.

Is the Rise in Bitcoin Price Sustainable

Not all price increases are sustainable. Some rallies are followed by corrections or market downturns.

Sustainability depends on strong fundamentals, continued adoption, and supportive economic conditions.

Opportunities and Risks During Rising Markets

Rising Bitcoin prices create opportunities for profit but also increase risk.

Opportunities

Investors may benefit from capital appreciation and increased market momentum.

Risks

Rapid price increases can lead to bubbles and sharp corrections.

Lessons for Investors from Rising Bitcoin Prices

Bitcoin price increases offer important lessons.

First, discipline is essential. Emotional buying during rallies can lead to poor decisions.

Second, diversification helps manage risk.

Third, understanding market cycles helps investors prepare for corrections.

The Role of Media and Social Networks

Media coverage and social networks play a significant role in amplifying Bitcoin price increases. Positive headlines and viral content can accelerate buying pressure.

Investors should balance media influence with careful analysis.

Future Outlook for Bitcoin Price Growth

Bitcoin’s future price growth depends on adoption, regulation, technological development, and global economic trends.

While uncertainty remains, many believe Bitcoin will continue to play an important role in the global financial system.

Conclusion

The rise in Bitcoin price reflects growing interest, adoption, and confidence in cryptocurrency. While price increases offer exciting opportunities, they also require careful analysis and risk management.

By understanding the factors behind Bitcoin’s price growth, investors can make wiser decisions and approach the market with confidence and long-term perspective.

The Rise in Bitcoin Price

Introduction

Bitcoin has become one of the most talked-about financial assets in the modern digital era. Since its creation in 2009, Bitcoin has experienced dramatic price movements that have captured global attention. Among these movements, the rise in Bitcoin price is often the most celebrated and discussed phenomenon.

The rise in Bitcoin price refers to periods when Bitcoin experiences a significant and sustained increase in value. These upward trends are driven by a combination of technological innovation, market demand, investor confidence, and global economic conditions. This article is written in a natural, handwritten-style tone and provides a comprehensive explanation in English about the rise in Bitcoin price, its causes, impacts, and what it means for investors.

Understanding Bitcoin Price Growth

Bitcoin operates in a decentralized market without central control. Its price is determined entirely by supply and demand across global exchanges that operate around the clock.

One of the most important characteristics of Bitcoin is its limited supply. Only 21 million Bitcoins will ever exist. This scarcity plays a major role in driving price increases, especially when demand grows rapidly.

What Does a Rise in Bitcoin Price Mean

A rise in Bitcoin price occurs when its value increases steadily over time or surges sharply within a short period. Price increases can be gradual or explosive, depending on market conditions.

For long-term investors, rising prices often confirm confidence in Bitcoin as a store of value or long-term investment. For traders, price increases create opportunities for profit but also involve higher risk.

Main Factors Behind the Rise in Bitcoin Price

Several key factors contribute to the rise in Bitcoin price.

Increased Adoption

One of the strongest drivers of Bitcoin’s price increase is growing adoption. More individuals, businesses, and institutions are using Bitcoin for investment, payments, and value storage.

As adoption expands, demand increases while supply remains limited, pushing prices higher.

Institutional Investment

Institutional involvement has significantly influenced Bitcoin’s price growth. When large financial institutions, hedge funds, and corporations invest in Bitcoin, it increases market credibility and demand.

Institutional buying often signals confidence and attracts more investors, accelerating price rises.

Scarcity and Halving Events

Bitcoin halving events reduce the reward miners receive for validating transactions. This reduction in new Bitcoin supply historically contributes to price increases.

When supply growth slows and demand remains strong, prices tend to rise.

Macroeconomic Conditions

Global economic conditions also play an important role. Inflation concerns, currency devaluation, and low interest rates often drive investors toward alternative assets like Bitcoin.

Bitcoin is increasingly viewed as digital gold, making it attractive during times of economic uncertainty.

Positive Market Sentiment

Market sentiment strongly affects Bitcoin prices. Positive news, technological developments, and successful adoption stories can generate optimism.

Optimistic sentiment encourages buying, which pushes prices higher.

Impact of Rising Bitcoin Prices on the Market

The rise in Bitcoin price affects the entire cryptocurrency ecosystem.

Altcoins

When Bitcoin prices rise, many alternative cryptocurrencies also experience price increases. This phenomenon is often referred to as a bull market.

Investor Confidence

Rising prices boost investor confidence and attract new participants to the market. Increased confidence often leads to higher trading volumes.

Mining Industry

Higher Bitcoin prices improve mining profitability, encouraging investment in mining infrastructure and technology.

Psychological Effects of Bitcoin Price Increases

Price increases generate excitement, optimism, and sometimes excessive enthusiasm. Fear of missing out often drives investors to buy during rising markets.

While optimism can support growth, emotional decision-making may increase risk if prices become overheated.

Historical Bitcoin Price Rallies

Bitcoin has experienced several major price rallies throughout its history. Each rally was driven by unique factors such as technological milestones, increased adoption, or macroeconomic shifts.

Studying these historical rallies helps investors understand patterns and manage expectations.

Is the Rise in Bitcoin Price Sustainable

Not all price increases are sustainable. Some rallies are followed by corrections or market downturns.

Sustainability depends on strong fundamentals, continued adoption, and supportive economic conditions.

Opportunities and Risks During Rising Markets

Rising Bitcoin prices create opportunities for profit but also increase risk.

Opportunities

Investors may benefit from capital appreciation and increased market momentum.

Risks

Rapid price increases can lead to bubbles and sharp corrections.

Lessons for Investors from Rising Bitcoin Prices

Bitcoin price increases offer important lessons.

First, discipline is essential. Emotional buying during rallies can lead to poor decisions.

Second, diversification helps manage risk.

Third, understanding market cycles helps investors prepare for corrections.

The Role of Media and Social Networks

Media coverage and social networks play a significant role in amplifying Bitcoin price increases. Positive headlines and viral content can accelerate buying pressure.

Investors should balance media influence with careful analysis.

Future Outlook for Bitcoin Price Growth

Bitcoin’s future price growth depends on adoption, regulation, technological development, and global economic trends.

While uncertainty remains, many believe Bitcoin will continue to play an important role in the global financial system.

Conclusion

The rise in Bitcoin price reflects growing interest, adoption, and confidence in cryptocurrency. While price increases offer exciting opportunities, they also require careful analysis and risk management.

By understanding the factors behind Bitcoin’s price growth, investors can make wiser decisions and approach the market with confidence and long-term perspective.

The Rise in Bitcoin Price

Introduction

Bitcoin has become one of the most talked-about financial assets in the modern digital era. Since its creation in 2009, Bitcoin has experienced dramatic price movements that have captured global attention. Among these movements, the rise in Bitcoin price is often the most celebrated and discussed phenomenon.

The rise in Bitcoin price refers to periods when Bitcoin experiences a significant and sustained increase in value. These upward trends are driven by a combination of technological innovation, market demand, investor confidence, and global economic conditions. This article is written in a natural, handwritten-style tone and provides a comprehensive explanation in English about the rise in Bitcoin price, its causes, impacts, and what it means for investors.

Understanding Bitcoin Price Growth

Bitco

The Rise in Bitcoin Price

•

Tinggalkan Balasan