The Decline of Bitcoin

Introduction

Bitcoin has long been regarded as the pioneer of cryptocurrency and a symbol of financial innovation. Since its creation in 2009, Bitcoin has experienced dramatic price movements, attracting investors, institutions, and the general public. While Bitcoin is often associated with rapid price increases and record-breaking highs, periods of decline are also an important part of its history.

The decline of Bitcoin refers to phases when its price drops significantly over a certain period of time. These downturns can be caused by various factors, including market sentiment, macroeconomic conditions, regulatory pressure, and technological concerns. This article is written in a natural, handwritten-style tone and provides a comprehensive discussion in English about the decline of Bitcoin, its causes, impacts, and lessons for investors.

Understanding Bitcoin Price Movements

Bitcoin operates in a free and highly volatile market. Its price is determined by supply and demand, market perception, and investor behavior. Unlike traditional assets, Bitcoin does not have intrinsic cash flow or government backing, making its price highly sensitive to external influences.

Bitcoin price movements often follow cycles. Periods of rapid growth are usually followed by corrections or declines. These corrections are not necessarily signs of failure, but rather part of the market’s natural behavior. Understanding this cyclical nature is essential when analyzing Bitcoin’s decline.

What Does a Bitcoin Decline Mean

A Bitcoin decline occurs when the price falls significantly from a previous high. This decline can happen gradually or suddenly, depending on market conditions. Some declines last for weeks or months, while others may continue for years.

For long-term investors, a Bitcoin decline may represent a temporary market correction. For short-term traders, it can result in significant losses. The meaning of a Bitcoin decline depends largely on an investor’s strategy, time horizon, and risk tolerance.

Main Causes of Bitcoin’s Decline

There are many reasons why Bitcoin experiences price declines. These factors often interact with each other and amplify market movements.

Market Sentiment and Fear

Market sentiment plays a major role in Bitcoin’s price. Negative news, rumors, or uncertainty can quickly spread fear among investors. When fear dominates the market, many investors rush to sell, causing prices to fall rapidly.

Fear of missing out during price increases can quickly turn into fear of losing money during downturns. This emotional behavior contributes to sharp declines.

Macroeconomic Conditions

Global economic conditions have a strong influence on Bitcoin. Rising interest rates, inflation concerns, and economic uncertainty often lead investors to reduce exposure to risky assets, including cryptocurrencies.

During periods of economic tightening, investors may prefer cash or traditional safe-haven assets, leading to a decline in Bitcoin prices.

Regulatory Pressure

Regulation is one of the most significant factors affecting Bitcoin. Announcements of stricter regulations, bans, or legal uncertainty in major economies can negatively impact market confidence.

When governments introduce restrictive policies, investors may fear reduced adoption or limited access to crypto markets, triggering sell-offs.

Institutional Selling

Institutional investors play an increasingly important role in the Bitcoin market. When large institutions decide to reduce their exposure, the impact on price can be substantial.

Large sell orders can create downward pressure and influence market sentiment, accelerating the decline.

Technical Market Factors

Technical factors such as broken support levels, liquidation of leveraged positions, and algorithmic trading can intensify Bitcoin’s decline.

When key price levels are breached, automated trading systems may trigger additional selling, creating a cascading effect.

Impact of Bitcoin’s Decline on Investors

The decline of Bitcoin affects different types of investors in different ways.

Retail Investors

Retail investors are often the most emotionally affected by Bitcoin’s decline. Price drops can lead to panic selling and financial stress, especially for those who invested without proper risk management.

Institutional Investors

Institutional investors tend to have more structured strategies and longer time horizons. While declines may result in losses, institutions often use downturns to reassess positions or accumulate assets at lower prices.

Miners

Bitcoin miners are also impacted by price declines. Lower prices can reduce mining profitability, forcing inefficient miners to shut down operations. This can affect network dynamics and hash rate.

Psychological Effects of Bitcoin’s Decline

Bitcoin’s volatility has a strong psychological impact on investors. Sharp declines can cause fear, doubt, and loss of confidence. Media coverage often amplifies negative sentiment, increasing pressure on the market.

Understanding emotional responses and maintaining discipline is crucial for navigating Bitcoin downturns.

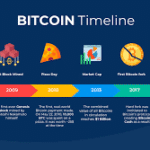

Historical Bitcoin Declines

Bitcoin has experienced several major declines throughout its history. Each decline was driven by different factors, yet Bitcoin continued to survive and evolve.

These historical downturns demonstrate that volatility is a defining characteristic of Bitcoin. Studying past declines helps investors gain perspective and avoid emotional decision-making.

Is Bitcoin’s Decline a Sign of Failure

Many critics view Bitcoin’s decline as evidence that it is unstable or unreliable. However, supporters argue that volatility is a natural feature of a new and evolving asset class.

Bitcoin’s decentralized design and limited supply remain unchanged during price declines. Whether a decline represents failure or opportunity depends on individual beliefs and investment strategies.

Lessons from Bitcoin’s Decline

Bitcoin’s downturns offer valuable lessons for investors.

First, risk management is essential. Investors should never invest more than they can afford to lose.

Second, diversification helps reduce exposure to a single asset.

Third, understanding market cycles and maintaining a long-term perspective can prevent emotional decisions.

The Role of Media in Bitcoin’s Decline

Media coverage plays a powerful role in shaping public perception. Negative headlines during price declines can increase fear and accelerate selling.

Balanced and informed analysis is important to avoid overreaction to short-term market movements.

The Future Outlook After Bitcoin’s Decline

After periods of decline, Bitcoin often enters phases of consolidation and recovery. Future performance depends on adoption, regulation, technological development, and macroeconomic conditions.

While uncertainty remains, Bitcoin continues to attract interest as a digital asset and alternative financial system.

Conclusion

The decline of Bitcoin is a natural part of its market cycle. While price drops can be challenging and emotionally difficult, they also provide opportunities for reflection, learning, and strategic decision-making.

By understanding the causes and impacts of Bitcoin’s decline, investors can make wiser decisions and approach the market with greater confidence and discipline.

The Decline of Bitcoin

Introduction

Bitcoin has long been regarded as the pioneer of cryptocurrency and a symbol of financial innovation. Since its creation in 2009, Bitcoin has experienced dramatic price movements, attracting investors, institutions, and the general public. While Bitcoin is often associated with rapid price increases and record-breaking highs, periods of decline are also an important part of its history.

The decline of Bitcoin refers to phases when its price drops significantly over a certain period of time. These downturns can be caused by various factors, including market sentiment, macroeconomic conditions, regulatory pressure, and technological concerns. This article is written in a natural, handwritten-style tone and provides a comprehensive discussion in English about the decline of Bitcoin, its causes, impacts, and lessons for investors.

Understanding Bitcoin Price Movements

Bitcoin operates in a free and highly volatile market. Its price is determined by supply and demand, market perception, and investor behavior. Unlike traditional assets, Bitcoin does not have intrinsic cash flow or government backing, making its price highly sensitive to external influences.

Bitcoin price movements often follow cycles. Periods of rapid growth are usually followed by corrections or declines. These corrections are not necessarily signs of failure, but rather part of the market’s natural behavior. Understanding this cyclical nature is essential when analyzing Bitcoin’s decline.

What Does a Bitcoin Decline Mean

A Bitcoin decline occurs when the price falls significantly from a previous high. This decline can happen gradually or suddenly, depending on market conditions. Some declines last for weeks or months, while others may continue for years.

For long-term investors, a Bitcoin decline may represent a temporary market correction. For short-term traders, it can result in significant losses. The meaning of a Bitcoin decline depends largely on an investor’s strategy, time horizon, and risk tolerance.

Main Causes of Bitcoin’s Decline

There are many reasons why Bitcoin experiences price declines. These factors often interact with each other and amplify market movements.

Market Sentiment and Fear

Market sentiment plays a major role in Bitcoin’s price. Negative news, rumors, or uncertainty can quickly spread fear among investors. When fear dominates the market, many investors rush to sell, causing prices to fall rapidly.

Fear of missing out during price increases can quickly turn into fear of losing money during downturns. This emotional behavior contributes to sharp declines.

Macroeconomic Conditions

Global economic conditions have a strong influence on Bitcoin. Rising interest rates, inflation concerns, and economic uncertainty often lead investors to reduce exposure to risky assets, including cryptocurrencies.

During periods of economic tightening, investors may prefer cash or traditional safe-haven assets, leading to a decline in Bitcoin prices.

Regulatory Pressure

Regulation is one of the most significant factors affecting Bitcoin. Announcements of stricter regulations, bans, or legal uncertainty in major economies can negatively impact market confidence.

When governments introduce restrictive policies, investors may fear reduced adoption or limited access to crypto markets, triggering sell-offs.

Institutional Selling

Institutional investors play an increasingly important role in the Bitcoin market. When large institutions decide to reduce their exposure, the impact on price can be substantial.

Large sell orders can create downward pressure and influence market sentiment, accelerating the decline.

Technical Market Factors

Technical factors such as broken support levels, liquidation of leveraged positions, and algorithmic trading can intensify Bitcoin’s decline.

When key price levels are breached, automated trading systems may trigger additional selling, creating a cascading effect.

Impact of Bitcoin’s Decline on Investors

The decline of Bitcoin affects different types of investors in different ways.

Retail Investors

Retail investors are often the most emotionally affected by Bitcoin’s decline. Price drops can lead to panic selling and financial stress, especially for those who invested without proper risk management.

Institutional Investors

Institutional investors tend to have more structured strategies and longer time horizons. While declines may result in losses, institutions often use downturns to reassess positions or accumulate assets at lower prices.

Miners

Bitcoin miners are also impacted by price declines. Lower prices can reduce mining profitability, forcing inefficient miners to shut down operations. This can affect network dynamics and hash rate.

Psychological Effects of Bitcoin’s Decline

Bitcoin’s volatility has a strong psychological impact on investors. Sharp declines can cause fear, doubt, and loss of confidence. Media coverage often amplifies negative sentiment, increasing pressure on the market.

Understanding emotional responses and maintaining discipline is crucial for navigating Bitcoin downturns.

Historical Bitcoin Declines

Bitcoin has experienced several major declines throughout its history. Each decline was driven by different factors, yet Bitcoin continued to survive and evolve.

These historical downturns demonstrate that volatility is a defining characteristic of Bitcoin. Studying past declines helps investors gain perspective and avoid emotional decision-making.

Is Bitcoin’s Decline a Sign of Failure

Many critics view Bitcoin’s decline as evidence that it is unstable or unreliable. However, supporters argue that volatility is a natural feature of a new and evolving asset class.

Bitcoin’s decentralized design and limited supply remain unchanged during price declines. Whether a decline represents failure or opportunity depends on individual beliefs and investment strategies.

Lessons from Bitcoin’s Decline

Bitcoin’s downturns offer valuable lessons for investors.

First, risk management is essential. Investors should never invest more than they can afford to lose.

Second, diversification helps reduce exposure to a single asset.

Third, understanding market cycles and maintaining a long-term perspective can prevent emotional decisions.

The Role of Media in Bitcoin’s Decline

Media coverage plays a powerful role in shaping public perception. Negative headlines during price declines can increase fear and accelerate selling.

Balanced and informed analysis is important to avoid overreaction to short-term market movements.

The Future Outlook After Bitcoin’s Decline

After periods of decline, Bitcoin often enters phases of consolidation and recovery. Future performance depends on adoption, regulation, technological development, and macroeconomic conditions.

While uncertainty remains, Bitcoin continues to attract interest as a digital asset and alternative financial system.

Conclusion

The decline of Bitcoin is a natural part of its market cycle. While price drops can be challenging and emotionally difficult, they also provide opportunities for reflection, learning, and strategic decision-making.

By understanding the causes and impacts of Bitcoin’s decline, investors can make wiser decisions and approach the market with greater confidence and discipline.

The Decline of Bitcoin

Introduction

Bitcoin has long been regarded as the pioneer of cryptocurrency and a symbol of financial innovation. Since its creation in 2009, Bitcoin has experienced dramatic price movements, attracting investors, institutions, and the general public. While Bitcoin is often associated with rapid price increases and record-breaking highs, periods of decline are also an important part of its history.

The decline of Bitcoin refers to phases when its price drops significantly over a certain period of time. These downturns can be caused by various factors, including market sentiment, macroeconomic conditions, regulatory pressure, and technological concerns. This article is written in a natural, handwritten-style tone and provides a comprehensive discussion in English about the decline of Bitcoin, its causes, impacts, and lessons for investors.

Understanding Bitcoin Price Movements

Bitcoin operates in a free and highly volatile market. Its price is determined by supply and demand, market perception, and investor behavior. Unlike traditional assets, Bitcoin does not have intrinsic cash flow or government backing, making its price highly sensitive to external influences.

Bitcoin price movements often follow cycles. Periods of rapid growth are usually followed by corrections or declines. These corrections are not necessarily signs of failure, but rather part of the market’s natural behavior. Understanding this cyclical nature is essential when analyzing Bitcoin’s decline.

What Does a Bitcoin Decline Mean

A Bitcoin decline occurs when the price falls significantly from a previous high. This decline can happen gradually or suddenly, depending on market conditions. Some declines last for weeks or months, while others may continue for years.

For long-term investors, a Bitcoin decline may represent a temporary market correction. For short-term traders, it can result in significant losses. The meaning of a Bitcoin decline depends largely on an investor’s strategy, time horizon, and risk tolerance.

Main Causes of Bitcoin’s Decline

There are many reasons why Bitcoin experiences price declines. These factors often interact with each other and amplify market movements.

Market Sentiment and Fear

Market sentiment plays a major role in Bitcoin’s price. Negative news, rumors, or uncertainty can quickly spread fear among investors. When fear dominates the market, many investors rush to sell, causing prices to fall rapidly.

Fear of missing out during price increases can quickly turn into fear of losing money during downturns. This emotional behavior contributes to sharp declines.

Macroeconomic Conditions

Global economic conditions have a strong influence on Bitcoin. Rising interest rates, inflation concerns, and economic uncertainty often lead investors to reduce exposure to risky assets, including cryptocurrencies.

During periods of economic tightening, investors may prefer cash or traditional safe-haven assets, leading to a decline in Bitcoin prices.

Regulatory Pressure

Regulation is one of the most significant factors affecting Bitcoin. Announcements of stricter regulations, bans, or legal uncertainty in major economies can negatively impact market confidence.

When governments introduce restrictive policies, investors may fear reduced adoption or limited access to crypto markets, triggering sell-offs.

Institutional Selling

Institutional investors play an increasingly important role in the Bitcoin market. When large institutions decide to reduce their exposure, the impact on price can be substantial.

Large sell orders can create downward pressure and influence market sentiment, accelerating the decline.

Technical Market Factors

Technical factors such as broken support levels, liquidation of leveraged positions, and algorithmic trading can intensify Bitcoin’s decline.

When key price levels are breached, automated trading systems may trigger additional selling, creating a cascading effect.

Impact of Bitcoin’s Decline on Investors

The decline of Bitcoin affects different types of investors in different ways.

Retail Investors

Retail investors are often the most emotionally affected by Bitcoin’s decline. Price drops can lead to panic selling and financial stress, especially for those who invested without proper risk management.

Institutional Investors

Institutional investors tend to have more structured strategies and longer time horizons. While declines may result in losses, institutions often use downturns to reassess positions or accumulate assets at lower prices.

Miners

Bitcoin miners are also impacted by price declines. Lower prices can reduce mining profitability, forcing inefficient miners to shut down operations. This can affect network dynamics and hash rate.

Psychological Effects of Bitcoin’s Decline

Bitcoin’s volatility has a strong psychological impact on investors. Sharp declines can cause fear, doubt, and loss of confidence. Media coverage often amplifies negative sentiment, increasing pressure on the market.

Understanding emotional responses and maintaining discipline is crucial for navigating Bitcoin downturns.

Historical Bitcoin Declines

Bitcoin has experienced several major declines throughout its history. Each decline was driven by different factors, yet Bitcoin continued to survive and evolve.

These historical downturns demonstrate that volatility is a defining characteristic of Bitcoin. Studying past declines helps investors gain perspective and avoid emotional decision-making.

Is Bitcoin’s Decline a Sign of Failure

Many critics view Bitcoin’s decline as evidence that it is unstable or unreliable. However, supporters argue that volatility is a natural feature of a new and evolving asset class.

Bitcoin’s decentralized design and limited supply remain unchanged during price declines. Whether a decline represents failure or opportunity depends on individual beliefs and investment strategies.

Lessons from Bitcoin’s Decline

Bitcoin’s downturns offer valuable lessons for investors.

First, risk management is essential. Investors should never invest more than they can afford to lose.

Second, diversification helps reduce exposure to a single asset.

Third, understanding market cycles and maintaining a long-term perspective can prevent emotional decisions.

The Role of Media in Bitcoin’s Decline

Media coverage plays a powerful role in shaping public perception. Negative headlines during price declines can increase fear and accelerate selling.

Balanced and informed analysis is important to avoid overreaction to short-term market movements.

The Future Outlook After Bitcoin’s Decline

After periods of decline, Bitcoin often enters phases of consolidation and recovery. Future performance depends on adoption, regulation, technological development, and macroeconomic conditions.

While uncertainty remains, Bitcoin continues to attract interest as a digital asset and alternative financial system.

Conclusion

The decline of Bitcoin is a natural part of its market cycle. While price drops can be challenging and emotionally difficult, they also provide opportunities for reflection, learning, and strategic decision-making.

By understanding the causes and impacts of Bitcoin’s decline, investors can make wiser decisions and approach the market with greater confidence and discipline.

The Decline of Bitcoin

Introduction

Bitcoin has long been regarded as the pioneer of cryptocurrency and a symbol of financial innovation. Since its creation in 2009, Bitcoin has experienced dramatic price movements, attracting investors, institutions, and the general public. While Bitcoin is often associated with rapid price increases and record-breaking highs, periods of decline are also an important part of its history.

The decline of Bitcoin refers to phases when its price drops significantly over a certain period of time. These downturns can be caused by various factors, including market sentiment, macroeconomic conditions, regulatory pressure, and technological concerns. This article is written in a natural, handwritten-style tone and provides a comprehensive discussion in English about the decline of Bitcoin, its causes, impacts, and lessons for investors.

Understanding Bitcoin Price Movements

Bitcoin operates in a free and highly volatile market. Its price is determined by supply and demand, market perception, and investor behavior. Unlike traditional assets, Bitcoin does not have intrinsic cash flow or government backing, making its price highly sensitive to external influences.

Bitcoin price movements often follow cycles. Periods of rapid growth are usually followed by corrections or declines. These corrections are not necessarily signs of failure, but rather part of the market’s natural behavior. Understanding this cyclical nature is essential when analyzing Bitcoin’s decline.

What Does a Bitcoin Decline Mean

A Bitcoin decline occurs when the price falls significantly from a previous high. This decline can happen gradually or suddenly, depending on market conditions. Some declines last for weeks or months, while others may continue for years.

For long-term investors, a Bitcoin decline may represent a temporary market correction. For short-term traders, it can result in significant losses. The meaning of a Bitcoin decline depends largely on an investor’s strategy, time horizon, and risk tolerance.

Main Causes of Bitcoin’s Decline

There are many reasons why Bitcoin experiences price declines. These factors often interact with each other and amplify market movements.

Market Sentiment and Fear

Market sentiment plays a major role in Bitcoin’s price. Negative news, rumors, or uncertainty can quickly spread fear among investors. When fear dominates the market, many investors rush to sell, causing prices to fall rapidly.

Fear of missing out during price increases can quickly turn into fear of losing money during downturns. This emotional behavior contributes to sharp declines.

Macroeconomic Conditions

Global economic conditions have a strong influence on Bitcoin. Rising interest rates, inflation concerns, and economic uncertainty often lead investors to reduce exposure to risky assets, including cryptocurrencies.

During periods of economic tightening, investors may prefer cash or traditional safe-haven assets, leading to a decline in Bitcoin prices.

Regulatory Pressure

Regulation is one of the most significant factors affecting Bitcoin. Announcements of stricter regulations, bans, or legal uncertainty in major economies can negatively impact market confidence.

When governments introduce restrictive policies, investors may fear reduced adoption or limited access to crypto markets, triggering sell-offs.

Institutional Selling

Institutional investors play an increasingly important role in the Bitcoin market. When large institutions decide to reduce their exposure, the impact on price can be substantial.

Large sell orders can create downward pressure and influence market sentiment, accelerating the decline.

Technical Market Factors

Technical factors such as broken support levels, liquidation of leveraged positions, and algorithmic trading can intensify Bitcoin’s decline.

When key price levels ar

The Decline of Bitcoin

•

Tinggalkan Balasan